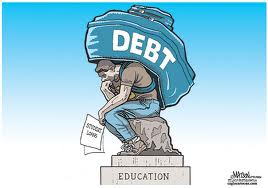

Uncovering the student loan myth.

The belief that student loans are never dischargeable in bankruptcy makes us us cringe every time we see it – and we see it a lot.

We cringe because it’s not true. You actually can get your student loan discharged in bankruptcy in some limited cases. In fact, according to a study published in 2011 by Jason Iuliano, at least 40 percent of borrowers who do include their student loans in their bankruptcy filing end up with some or all of their student debt discharged.

The problem is the old tale that has consumers thinking there’s no chance to have these loans discharged, so they don’t try. Iuliano’s report found that only about 0.1 percent of consumers with student loans attempt to include them in their bankruptcy proceedings.

To be clear, if you borrow money, you have a moral and legal obligation to pay that money back, even if that means making some financial sacrifices. It is strongly recommended that students do more cost-benefit analysis and long-range planning before taking on student debt of any amount.

But sometimes life throws students some pretty big curve balls that they just can’t plan for or recover from, and it’s in those cases that bankruptcy comes into play. If you’re in that position, here are the most important things you need to know about student loans and bankruptcy.

We strongly advises you call Firebaugh & Andrews to get a free consultation 734-722-2999

• Check if you pass the test: Current bankruptcy law exempts education loans and obligations from eligibility for discharge unless doing so would cause the consumer undue hardship. The problem is that undue hardship is not defined within bankruptcy law, leaving the bankruptcy courts to decide what this means.

Next Post

Next Post